The JobKeeper wage subsidy program has been extended until March 2021, although it is at lower rates and with additional eligibility testing for small businesses and sole traders.

Initially it was expected the government would move to limit additional income support by only providing it to sectors still subject to trading restrictions like hospitality and tourism. However, Treasury concluded this would be impractical, instead recommending government re-test business eligibility at the end of September and again in early January.

Changes to JobKeeper

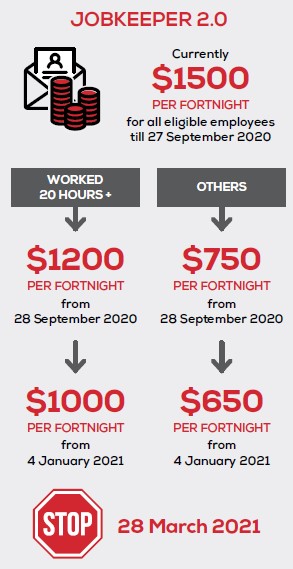

From 28 September 2020 to 3 January 2021, the payment rate will be $1,200 per fortnight for those who were employed full-time in the four weeks before 1 March 2020.

Employees working in the business for less than 20 hours a week on average will receive $750 per fortnight instead of the current single rate of $1,500.

However, this will reduced from 4 January 2021.

From 4 January 2021 to 28 March 2021, the payment rate will be reduced to $1,000 per fortnight for full-time workers, and $650 for part-time employees working 20 hours a week or less.

The government has confirmed that businesses and not-for-profits entering JobKeeper 2.0 will be required to nominate which payment rate they are claiming for each of their eligible employees or business participants.

Revised Eligibility Tests – all industries

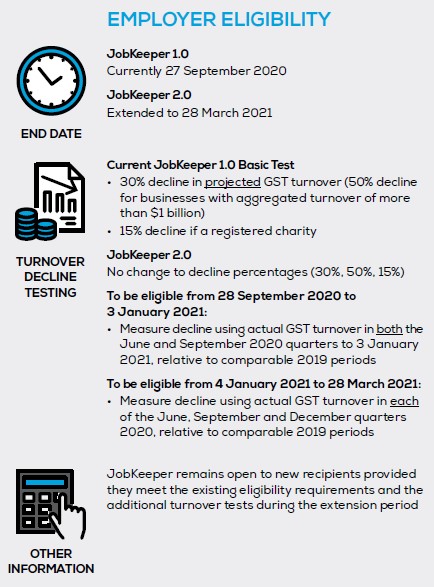

Businesses will be required to demonstrate an actual decline in turnover against a comparable period, rather than forecasts.

From 28 September, businesses wanting to remain on JobKeeper will also need to prove they suffered an actual decline in turnover for the June and September quarters.

From 4 January 2021, businesses will need to reconfirm their turnover shortfall for each of the June, September and December 2020 quarters.

Change : Actual decline in turnover

(not projections)

These tests will run along the same turnover criteria previously used, with employers required to demonstrate their turnover declined at least 30% for businesses with turnover less than $1billion (chartities will need to show a 15% shortfall).

The Treasurer has confirmed that the Commissioner of Taxation will have discretion to set out alternative tests that would establish eligibility in specific circumstances where it is not appropriate to compare actual turnover in a quarter in 2020 with actual turnover in a quarter in 2019.

What if I don’t meet the additional turnover test? Will the ATO discontinue my current payments before 28 September?

No. If a business or not-for-profit does not meet the additional turnover tests for the extension period, this does not affect their eligibility prior to 28 September 2020.

Can new businesses qualify for JobKeeper?

Yes, the Treasurer has also confirmed that the JobKeeper payment will continue to remain open to new recipients, provided they meet the existing eligibility requirements and the additional turnover tests during the extension period.

Will payments still be in arrears?

Yes, the Treasurer has confirmed that the JobKeeper payment will continue to be made by the tax office to employers in arrears.

Employers will also continue to be required to meet the wage condition, meaning they will need to make payments to employees equal to, or greater than, the amount of the JobKeeper payment (before tax), based on the payment rate that applies to each employee.

Help me!

We understand that business owners would rather focus on their business so we have put together a JobKeeper Package. Which includes confirming your employer eligibility, employee eligibility & eligible business participants. Register & lodge monthly JobKeeper information with the Australian Taxation to ensure everything is documented & lodged on time.

Horizon Group – JobKeeper Package

$330 eligibility, setup and month one processing

$165 per month (as required)

Contact us: clientservices@horizonacc.com.au

Phone: 08 9344 7799

Other Useful links

Simple! Smart! Different!

This information is intended to provide general information only and has been prepared without taking into account any particular person’s objectives, financial situation or needs. Before acting on such information, you should consider the appropriateness of the information

Copyright © 2020

The Horizon Group of Companies

All rights reserved.

Contact us

www.thehorizongroup.com.au

email: info@thehorizongroup.com.au

phone: 08 9344 7799

see us: 35 Cedric Street, Stirling WA